Getting smart about using data

Using information smartly and responsibly is key to serving customers better, says Ranil Boteju, Global Head of Data Analytics in HSBC’s Wealth and Personal Banking business.

What do data analysts do?

Like many big businesses, HSBC has access to vast amounts of data – everything from credit card spending data and payment networks, to patterns of visits to branches and mobile app usage.

My team’s job is to organise and enrich that data by converting it into thousands of behavioural signals, and then make sense of it using a range of statistical, machine learning and visualisation techniques. We then turn it into opportunities for serving our customers better, making the bank more efficient and protecting them from fraud.

The past few years have been an exciting time to be in my role because improved computer processing, data storage and machine learning technologies have made it easier to analyse data than ever before. Analytics now plays a key part in transforming the way HSBC works.

How does data analytics help customers?

Using information smartly can make a customer’s experience smoother and more secure. In Hong Kong, for instance, we built an algorithm to make it easier to apply for a basic life insurance product. The algorithm analyses a range of data, including credit transaction information, to rate a customer’s eligibility for the product, allowing some customers to avoid answering application questions.

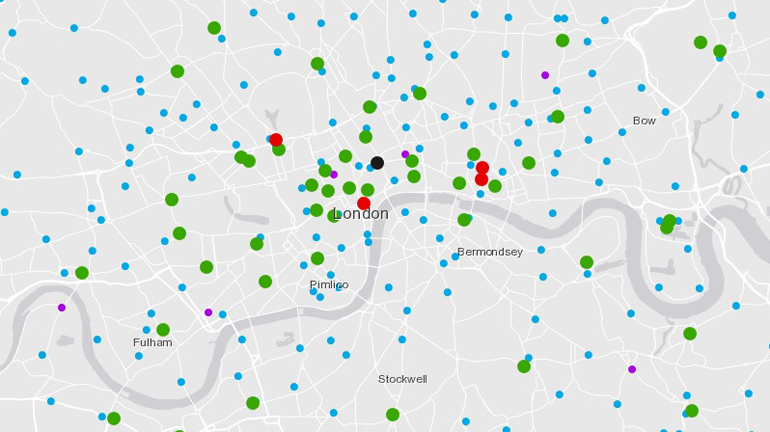

We can also help make sure HSBC is where customers need it to be. For example, when the bank is opening a new branch or ATM somewhere, we analyse data about our customers shopping patterns, land use, journey to work and foot traffic around that area. This helps us decide exactly where to position the branch or ATM, ensuring our customers will get the best use out of it.

Analytics can help give colleagues working in branches and call centres up-to-date information to help them support customers. When some UK post offices and HSBC branches had to change their operating hours during the coronavirus outbreak, for instance, we developed a live dashboard to let colleagues know instantly what facilities were available where, and direct customers accordingly.

Data also has a role to play in keeping customers safe. We can use what we know about customers, such as their age and length of time they have been banking online, to set automatic rules for their online banking experience. An older or more vulnerable customer taking up digital banking for the first time may appreciate support, for instance, so we can increase the frequency of pop-up messages offering help, and alerting them to any suspicious activity. Data enables us to target this at only the potentially vulnerable customers.

Behind the scenes, too, data analytics can speed up our processes. The techniques we use include natural language processing and optical character recognition, which converts handwritten text – such as on loan applications – meaning people don’t have to spend time transcribing it by hand or listening in to audio recordings, and making it quicker to perform routine sales and quality checks. Customers might not see these tools in action, but they are helping us work more efficiently, and spend more time focusing on what customers need.

How do you make sure that people are at the heart of our approach to technology?

I think businesses that demonstrate clear ethical principles in the way they use technology and data have the opportunity to differentiate themselves in the years to come.

HSBC has published a set of principles about the use of big data and artificial intelligence, and we have taken time to build those principles into the way we do data analytics. The foundation of our approach is that we aim to be certain that what we are doing is for the benefit of the customer, and in their best interests.

Fairness is a key principle

Fairness is another key principle. Machine learning programs analyse historical data to make predictions about the future. In some societies, different groups of people may have been treated unfairly in the past – because of their gender or ethnicity, for example – and those biases could be reflected in historical data. Being alert to this is vital. We constantly monitor the outcomes delivered by our algorithms and aim to ensure they do not lead to unfairly biased outcomes.

To find out more about these principles and how they fit in with our commitment to doing business responsibly, read about Our conduct.

How did you get into your role, and what advice would you have for new joiners?

I graduated in chemical engineering and spent six months working as an engineer in the desert in Western Australia before deciding I really wanted to do something else. I came back to Sydney when data science in business was taking off. The skills you need as a chemical engineer – statistics, maths and problem-solving – are also valuable when using data to fix business problems.

Twenty years later we recruit people from a broad range of disciplines including mathematics, business, computer science, behavioural economics and engineering. You don’t necessarily have to be an expert in statistics because we can teach you. But the key questions are – are you curious? Do you like solving problems? Do you think like a detective? And can you keep on learning?

The world of data science is changing so fast that the tools and techniques we use today are very different from even two years ago. It’s constantly evolving and presenting new challenges. Which means we need people who are continuously learning and updating their skills.

Wealth and Personal Banking

We help millions of customers to manage their finances, protect and grow their wealth.