Web3: It’s time to level up

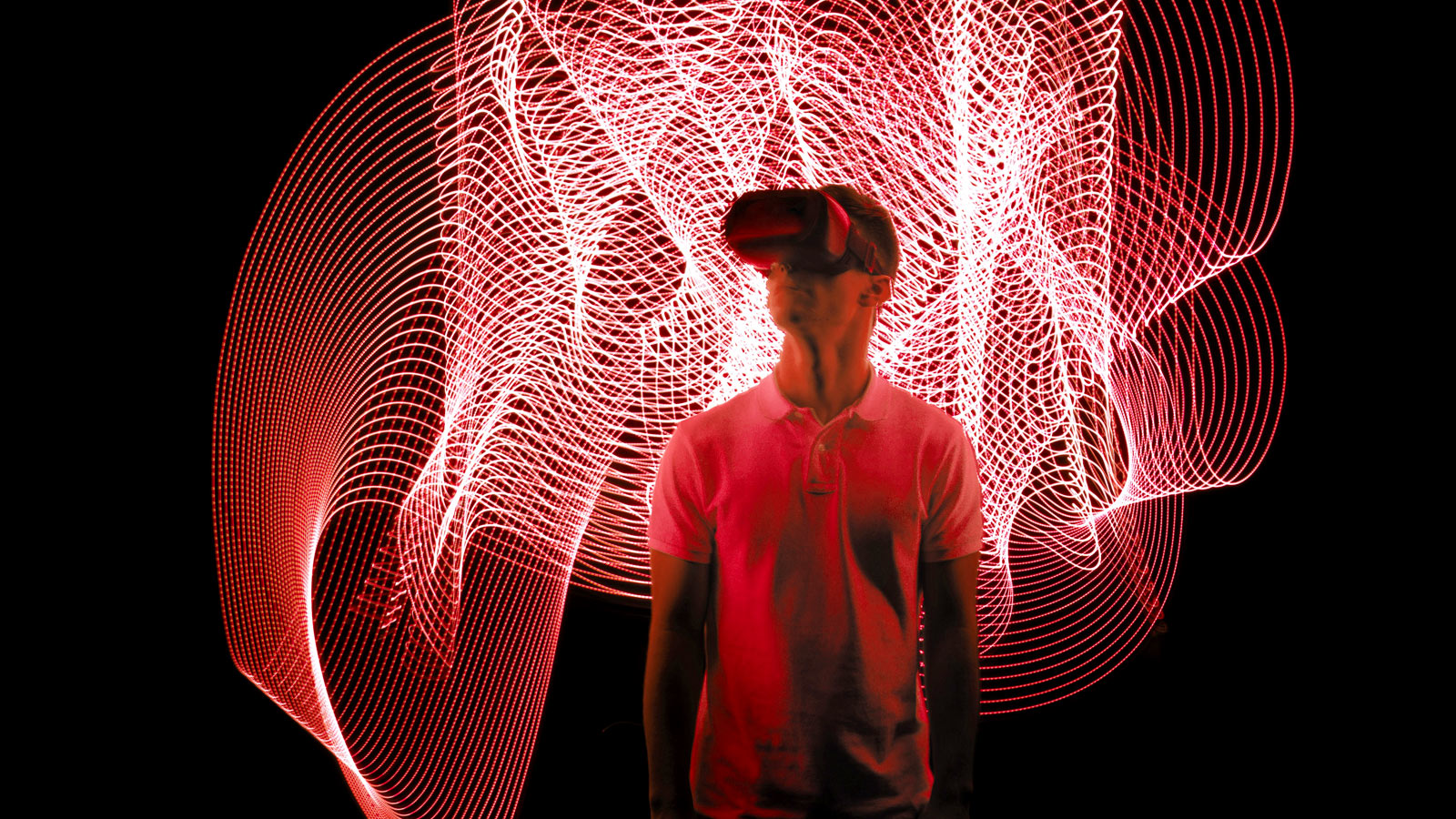

Web 1.0 and 2.0? Been there, done that. In the new world of Web3, a digital version of you can buy your own land, watch your favourite musicians perform live – or perhaps visit a virtual exhibition and buy some digital art. HSBC’s Rajeev Tummala, Director of Digital and Data, Securities Services, explains more.

Web3 is the read-write-own era of the internet

It’s the era where users can occupy new virtual worlds via the metaverse. Web3’s opportunities and functionality are powered by artificial intelligence, machine learning, and virtual and augmented reality – as well as distributed ledger technology and smart contracts.

A driving principle of Web3 is that users keep control of their own data and create more directly, rather than via third parties.

What came before

Web 1.0 is the read-only or syntactic web – largely a content delivery network that had minimal user interaction.

Web 2.0, also known as the social web or read-write web, redefined how we socialise, communicate, shop and share online. Here, companies create centralised platforms that depend on user-generated content. Think social media, and cookie-driven functionality.

It’s an open source world

Web3 takes open source beyond just code to data and even ideas. When an application built on blockchain is replicated, for example, the underlying dataset comes with it.

Designs and protocols are available for anyone to use. Limits and constraints to innovation disappear. New applications and protocols are reimagining traditional business models at an unprecedented pace.

The biggest buzz is around the metaverse

You might have thought we’d already digitised it all, but the metaverse is proof that we can imagine beyond the current applications of the internet.

In the metaverse, you control and deploy a digital character – or avatar – to experience and interact with digitised environments and other avatars in those environments.

Those environments could include shops where avatars can browse for and buy products – products that may be virtual or exist in the real world, or both. And they can include venues for avatars to attend to enjoy virtual experiences, as HSBC has developed in partnership with The Sandbox (opens in new window)

If the prospect seems crazy, take a look at gaming

There’s roughly a 50% chance that if you’re reading this, you’re a gamer yourself, because there are an estimated three billion gamers worldwide, in an industry worth hundreds of billions of dollars.

Popular games such as Fortnite are brimming with additional opportunities to engage with players – music artists like Ariana Grande and Marshmello have held live concerts inside games, performing as their avatars to the players’ avatars in the audience.

The metaverse is not just for games

Uses can extend to education, travel, arts, entertainment, live events, consumer goods, and more.

For example, Microsoft’s Mesh mixed-reality collaboration platform will allow people in different locations to join shared holographic experiences. And Decentraland hosted a four-day metaverse festival in October 2021 that featured 80 artists and attracted 50,000 virtual attendees. Analysts say the metaverse market could be worth $800 billion by 2024.

Corporations have to decide when to enter this world

And not just with stadia and experiences. This is a critical juncture for businesses to explore, experiment, take calculated risks, fail fast and learn faster, to understand what it takes to offer services in this space with the potential to provide immense value for clients.

Financial services companies, including HSBC, are starting to dip their toes in with projects around tokenisation and central bank digital currencies, and services around digital assets.

Web3 offers many opportunities in financial services

And that stretches beyond the potential to visit a virtual branch, to check out virtual products and services. Where there is an economy, there will be financial transactions – this universe requires registrars to securely keep ownership records and preserve its integrity.

The traditional financial services industry is famously bogged down by legacy technology problems – for instance, different IT systems struggling to interact with one another.

With Web3 developments such as smart contracts, any processes and transactions can be turned into a few lines of code, and these repeatable building blocks can be constructed into a range of applications, offering the possibility of highly customised products and services.

Web3 poses some new challenges on familiar issues

Uncertainty about intellectual property protection, application of accounting standards, anti-money laundering, know-your-customer, and data privacy risks are some of them.

In a Web3 world with pseudo-anonymous ‘wallets’, how can taxes be collected? What transactions should be taxed and how can information be gathered to ensure compliance? Can digital identity help resolve this conundrum? Information security demands attention, too. International alignment from regulators is critical to bring maturity to Web3.

How different Web3 will be remains to be seen

Web3’s most ardent supporters predict it will bring forward an entirely new decentralised economic system. However, some of its loftiest ambitions may not be realised, and some parts of it will be little different from our current internet. We’re likely to see a world driven by both centralised and decentralised systems and business models. And, regardless of how Web3 evolves, it’s clear there is a role for financial institutions to play.

Read more in our full report (opens in new window) (opens in new window)

New forms of digital money could spur growth

Central Bank Digital Currencies have the potential to make payments cheaper, says our Group CEO.