Introduction

How did a local Hong Kong bank become one of the world’s great financial services organisations? This is the story of our origins, growth, challenges and international expansion – and how we have been opening up a world of opportunity for 160 years.

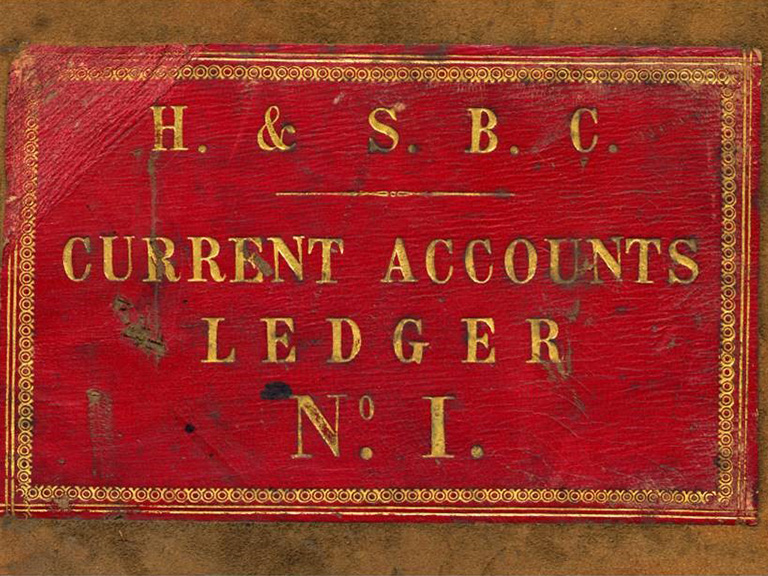

Local bank opens to support trade

The Hongkong and Shanghai Banking Corporation Limited, as it was known then, was founded by Thomas Sutherland, a young Scotsman who worked in Hong Kong for a large shipping firm.

Local and foreign trade in Hong Kong and at ports in China and Japan had increased rapidly in previous years, and Sutherland recognised that businesses needed better local banking facilities. By the time Sutherland’s prospectus was published, and backed by Hong Kong’s biggest firms, he had raised of HKD5 million of founding capital, [almost HKD100m in today’s money].

The 20,000 shares issued sold quickly and we opened our doors – in Hong Kong on 3 March 1865 – and in Shanghai a month later.

Our first office was in Wardley House at 1 Queen’s Road in the heart of Hong Kong’s Central district. 1 Queen’s Road Central remains our Hong Kong headquarters today.

1865

The first branch

HSBC’s head office, Wardley House, in Hong Kong (pictured above).

In July 1865, the bank opened an office in London to facilitate foreign exchange services for clients in China and India and to help recruit and train junior bankers.

1875

Spreading its wings

International trade has always been at the heart of our business. By 1875, the bank had expanded into seven countries across Asia, Europe and North America, with branches in the ports of Yokohama, Japan (pictured above); Calcutta (Kolkata), India; Saigon (Ho Chi Minh City), Vietnam; and Manila, Philippines. We financed exports, including tea and silk from China, cotton and jute from India, and sugar from the Philippines.

1900

The age of Jackson

The much-respected Thomas Jackson (seated, centre) was our Chief Manager three times between 1876 and 1902. The bank prospered under his management and, by the turn of the 20th century, we operated in 16 countries and territories. We also grew our government finance business, issuing many loans for infrastructure projects, including China’s first public loan in 1874.

Surviving in challenging times

War and economic disruption inevitably meant that the first half of the 20th century was a difficult time for many people and, despite our focus in Asia, we were still affected by the First World War. Forty of the 169 HSBC employees from the bank’s London office who joined the British forces during the war were killed or listed as missing in action.

After the First World War, the bank expanded in Asia, where trade in rubber and tin was booming, opening branches in Bangkok, Manila and Shanghai, which underlined our confidence in the region. In the 1930s, during the Great Depression, our inner reserves were drawn down and the bank focused most of its resources on survival rather than expansion. Staff bonuses were cut or cancelled and shareholder dividends were reduced.

The Second World War was an even tougher period for the bank. It survived thanks to its significant reserves and careful management, which allowed the business to retain a strong foundation for growth when peace returned.

1923

A new Shanghai office

HSBC was the leading foreign bank in China through the 1920s. In 1923 we opened a new office (above) on Shanghai’s waterfront, the Bund. The entrance featured a Venetian mosaic dome (pictured) and our first pair of lions, nicknamed Stephen and Stitt after senior managers from this era. The branch financed local tea and silk exporters and provided foreign exchange services.

Meet the HSBC Lions, Stephen and Stitt (opens in new window) , and follow their journey from Shanghai and Hong Kong across the globe.

1941-45

Our darkest hours

Following advances by the Japanese army in December 1941, including on Hong Kong, we were forced to shut most of our network in Asia. Our employees often showed tremendous courage, sticking to their posts until the last minute to help customers, though many staff members were captured and interned. We relocated our head office to London on 16 December 1941.

Part one of a trilogy exploring HSBC's experiences during the Second World War (opens in new window) (opens in new window)

Part two of a trilogy exploring HSBC's experiences during the Second World War (opens in new window) (opens in new window)

1946

Rebuilding the economy

Following the end of the war, HSBC moved its head office back to Hong Kong.

We played a key role in the reconstruction of the local economy. Hong Kong was reinventing itself as a manufacturing centre and the bank began a new line of business, granting loans to build cotton mills and textile factories.

Branching into new territories

The postwar decades were a period of great change and growth for HSBC. During the 1950s the bank closed its China network – apart from its Shanghai branch – following the establishment of the People’s Republic of China, and started to make its first acquisitions. We acquired the British Bank of the Middle East (BBME; pictured above is a banknote issued by BBME in the early 20th century) and the Mercantile Bank in 1959.

In Hong Kong we focused on retail banking and industrial financing in the 1960s and 1970s, opening a large branch network, and responded to competition by founding our own investment banking subsidiary, Wardley, in 1972.

1959

India, the Middle East, and the USA beckon

HSBC accelerated its transformation into a global business in 1959 with the acquisition of The British Bank of the Middle East, a pioneer in the Gulf states. Later that year, we also expanded our footprint in India, buying the Mercantile Bank. Hong Kong’s leading private Chinese bank, Hang Seng Bank, joined the HSBC Group in 1965 when a crisis hit the Chinese banking sector. HSBC came to its rescue by taking a majority stake in the business. In 1980, we took an important step outside Asia, buying a controlling stake in the American bank, Marine Midland – taking full ownership in 1987, which put HSBC on the path to becoming a truly global bank.

1967

New technology

HSBC’s first computer, the IBM 360, arrived at our head office in Hong Kong in 1967, allowing the bank to computerise customers’ accounts. This revolutionised the way people could bank as, for the first time, customers could use any HSBC branch in Hong Kong.

1984

Rebuilding a presence in China

As we’ve had a continuous presence in China since 1865, we were well-positioned when, in the late 1970s, China started to open up to foreign investment again. In 1984, HSBC became the first foreign bank since 1949 to be granted a banking licence in mainland China, for its branch in Shenzhen. Pictured above is a 1980s brochure illustrating business opportunities in China.

A global business

After deals in the Middle East, India and the US, we needed a strong foothold in Europe to complete our international transformation. In 1992, we achieved this through the acquisition of Midland Bank in the UK. Our long experience and diversification helped weather the Asian financial crisis, the global financial crisis and the challenges that followed. In recent years we have implemented a series of closures and disposals, making HSBC easier to manage and better positioned to capitalise on growth opportunities.

In China, however, we have grown: both organically, following the establishment of HSBC Bank China in 2007; and through a series of alliances with Chinese financial institutions.

1992

Buying the listening bank

Midland Bank – whose slogan was ‘the listening bank’ – first opened for business in Birmingham in 1836. HSBC bought Midland in 1992 in one of the biggest deals in banking history. To comply with the conditions of the takeover, HSBC established HSBC Holdings plc in London as a parent company for the expanding group.

1998

A single global brand

In 1998, the bank decided to adopt a unified brand worldwide, using HSBC and its red-and-white hexagon logo everywhere it operated. The hexagon symbol was derived from the bank’s original house flag, which in turn was based on Scotland’s flag.

2010

Focus on China

Since the start of the 21st century HSBC has expanded its business in China. The bank opened its new Shanghai headquarters in the city’s Pudong district in 2010, the same year it opened its 100th office in the country. And in 2017, HSBC Qianhai Securities Limited began operating – the first joint venture securities company in mainland China to be majority-owned by a foreign bank.

2020

Supporting communities during COVID-19

HSBC took a range of measures to support coronavirus recovery efforts, ranging from relief for personal lending customers to extra lending for wholesale clients. Investment in technology helped employees work from home to deliver a continuous service. The bank’s USD25 million charitable fund also provided help where it was needed most.

2020-2024

Cementing our presence in key markets

As we approach our 160th anniversary since opening in Hong Kong and Shanghai, we remain committed to our key global markets and international connectivity. We opened new headquarters in Singapore (2020), Malaysia (2021) and the USA (2024) – and started the relocation of our London premises. Pictured is our new US headquarters at The Spiral, 66 Hudson Boulevard East, New York City.

Keep exploring

At HSBC, we believe that how we do business is as important as what we do. Find out more about how we operate, our performance and our strategy.

Our history in depth

Visit the HSBC History website to explore the bank’s rich and colourful heritage in depth, and access our unique archives.