May newsletter

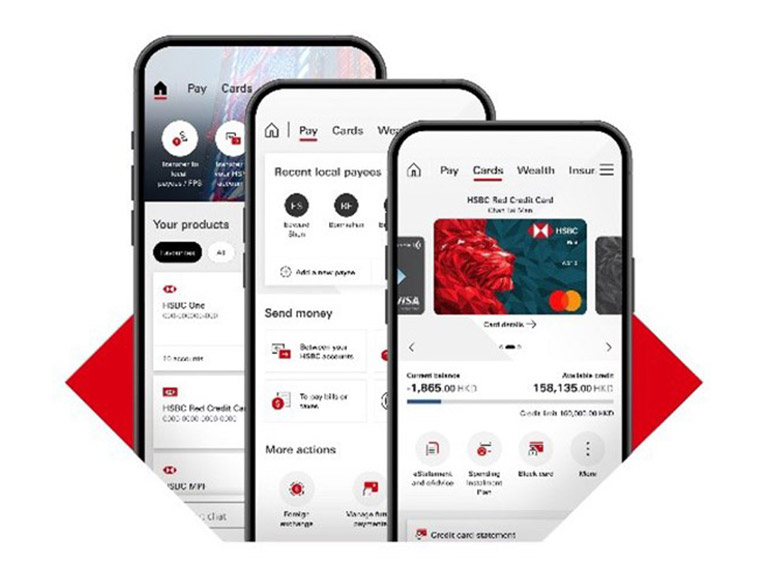

We’re transforming mobile banking

We’ve announced the launch of our refreshed mobile banking app for customers in Hong Kong.

The upgrade, which has been rolling out in phases since mid-May, will transform how our customers manage their daily finances, offering a more intuitive and personalised digital banking experience.

“As the leading bank in Hong Kong, we are also the most digitally accessible bank, servicing our customers 24/7,” said Maggie Ng, our Head of Wealth and Personal Banking, Hong Kong.

“The HSBC HK app is a key customer touch point for HSBC. We remain committed to delivering cutting-edge technology that makes the banking experience seamless and secure for everyone.”

This is a customer-led revamp. Based on customer feedback, the refresh prioritises improved navigation and enhanced personalisation as essential benchmarks for delivering an excellent mobile banking experience.

“Mobile banking offers unmatched efficiency and convenience,” said Kazimierz Kelles-Krauz, our Head of Digital Channels, Wealth and Personal Banking, Hong Kong.

“In 2024, we introduced 463 new features to enhance our mobile banking experience. However, we recognise that many of them remain underutilised due to navigation challenges.

“The latest upgrade features a holistic redesign of our app’s service journey and interface, ensuring easier access to the tools customers need to get the most from mobile banking.”

Our reimagined mobile app launched in the UK earlier this year. Singapore is due to go live towards the end of this year – with further markets set to upgrade in 2026.

Find out more about our refreshed mobile banking app

Navigating a world of change

The current trading environment is evolving rapidly and it’s unclear where things will settle.

We’re working with businesses – to plan for different scenarios, and to adapt their strategies and supply chain models.

We’re also investing in digital trade platforms and innovative financing solutions.

“The world of trade is facing unprecedented disruption, and global trade will look different in the coming years,” said Vivek Ramachandran, our Head of Global Trade Solutions.

“As the world’s #1 trade bank, our priority is to support clients through this period of uncertainty – as a strategic partner and innovative problem solver.”

How we’re helping our clients:

- We launched HSBC TradePay for Import Duties, to simplify the payment of import duties for US businesses

- We’re continuing to explore the latest developments, through webinars, podcasts and discussions

- Our recent Global Trade Pulse survey suggests that global businesses are braced for surging costs, but optimism about international trade endures

A partnership to accelerate climate tech innovation

We’re supporting a new three-year philanthropic partnership that aims to speed up the deployment of innovative climate technologies within heavy industries across Asia and the Middle East.

Together with Third Derivative and Founders Factory, we launched the Future Industries Partnership (FIP) at Ecosperity 2025 in Singapore earlier this month.

We’ll provide philanthropic funding for the FIP and give early stage start-ups hands-on technical and commercial support to make their propositions more attractive to investors and partners.

“By connecting start-ups, corporates, investors, and financial institutions, the FIP aims to use our global network to help take game-changing ideas and make them a reality, opening up opportunities for economic growth,” said Julian Wentzel, our Group Chief Sustainability Officer.

Heavy industry companies such as those in the steel, cement and chemicals sectors face some of the biggest net zero transition challenges globally.

These include high energy demand, infrastructure and supply chain constraints, long asset lifecycles and large capital requirements.

India, Southeast Asia and the Middle East have been prioritised by the FIP as they have high emissions growth rates, coupled with the highest opportunity for industrial decarbonisation.

Currently, only around 25% of the technologies needed to reach net zero are mature, according to the International Energy Agency.

Stephen and Stitt take pride of place in Dubai

Our HSBC lions, Stephen and Stitt, have arrived in the Middle East for the first time.

They’re now standing guard outside HSBC Tower in Dubai, United Arab Emirates, and will soon be unveiled at our refurbished office in Cairo, Egypt.

The lions, cast in bronze, have symbolised our strength and stability for more than 100 years since first appearing in Shanghai in 1923 – and now appear in a number of markets across the world.

A blessing ceremony was observed in Dubai this month, complete with incense and red cloths to invoke prosperity.

“Bringing our iconic lions to the UAE is a powerful symbol of our nearly 80-year legacy in this market and our readiness to invest further to support our customers and the economic transformation,” said Mohamed Al Marzooqi, our CEO in the UAE.

The Dubai event mirrored similar ceremonies held in Hong Kong and London, underscoring the lions’ global legacy.

Customers and colleagues in the UAE can now take part in the established tradition of rubbing the lions’ paws for luck.

The Dubai lions are copies of the two that guard HSBC UK headquarters in Birmingham, while the two heading for Egypt were previously on display in Canada.

Catch up on the Feng-shui inspired ceremony outside HSBC Tower Dubai in our video.