Easy, helpful mobile banking

Our digital innovations are putting the full power of our bank in every customer’s pocket, whether you’re a first-time saver, a budding start-up or a multi-national business.

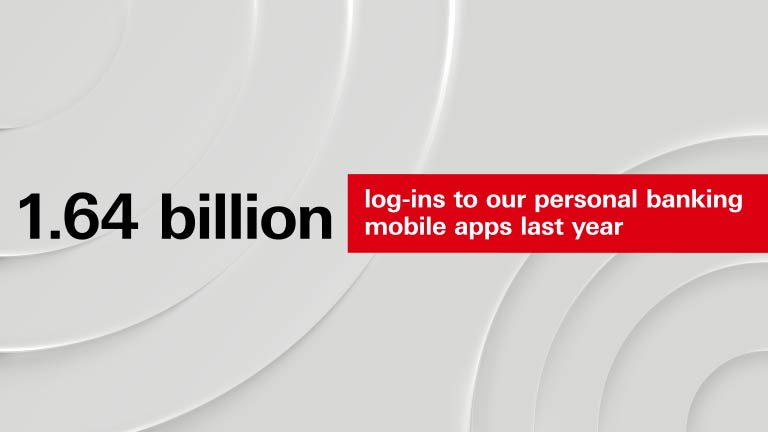

Demand for our apps is rocketing. We get more than a billion log-ins a year from personal banking customers alone.

One account, many currencies

With this tech our customers can wave goodbye to the bureau de change – and spend like a local, wherever they are.

Pay with a tap

You can even split your bill with millions of users of our PayMe app in Hong Kong.

Your wallet, worldwide

Take your business to new markets with our global payment tech.

The innovations making banking more secure

HSBC is constantly innovating to keep your money safe – when it’s in your accounts and when you’re spending it.

We take our responsibility seriously – whether that’s keeping cyber-attacks at bay or locking out financial criminals.

From our industry-leading data science tools to our expert analysts and investigators, you can count on us to help safeguard the financial system on which millions of people depend.

Meet the hacker hunter

He used to be ‘red team’. Now Ezequiel is ‘blue team’ – putting cyber-threats on ice.

Get cyber savvy

We do our bit, and we help you do yours. These top tips will keep your money safe.

This tech roots out criminals

Check out the data analytics tool that helps to screen 1.1 billion transactions every month.

Digitising banking

We use the latest in blockchain, artificial intelligence and machine learning technology to make our customers’ lives easier.

Simplifying trade

We’re using blockchain tech to cut transaction times to less than 24 hours from 10 days.

How we use data

Keeping the bank and our customers safe, and delivering better products and services.

Digital news and trends

Digital currency: Our pilot in Hong Kong

See what happened when 200 students took part in our two-week, hypothetical e-HKD pilot at HKUST Business School.

Web3: It’s time to level up

Web 1.0 and 2.0? Been there, done that. Find out what Web3 has in store for you – or digital you.

Tokenisation: Driving financial innovation and conservation

Digital tokens could transform gold into a net zero asset – and protect the future of the Amazon rainforest.

Meet our tech wizards

We’re home to the some of the best digital and technology minds in the industry.

Introducing a tech wizard

Meet the data scientist who’s turning numbers into magic, harnessing the awesome power of artificial intelligence.

Become a tech wizard

Want to join us? We have openings in the brilliant teams who are working to make banking better.